In the dynamic world of entrepreneurship, the art of reaching out and securing the attention of an investor is pivotal to the success of any start-up. Mastering How to Write a Cold Email to an Investor? is not just a skill; it’s an essential element in the toolbox of any entrepreneur aiming to take their venture to the next level.

Direct Answer: To write an effective cold email to an investor, craft a compelling subject line, structure the email body coherently, personalize the content, demonstrate value, include pertinent attachments or links, and follow up with a clear strategy.

Understanding the Importance of Cold Emails to Investors

Cold emails are the digital age’s handshake, offering an introduction to potential investors who might otherwise be out of reach. They function as the first point of contact and are crucial when you don’t have a mutual connection. Not every cold email will strike gold, but as an entrepreneur, it’s a vital strategy for casting a wide net and possibly landing that game-changing investment.

Preparing for Your Cold Email Campaign

The Importance of Research Beforehand

It’s crucial to know who you’re emailing. Understand your investor’s past investments, their preferred industries, and their business philosophies. Personalization goes a long way – show that you’re not just casting a random net but reaching out with a purpose.

Constructing a Targeted Investor List

Identify investors who are the best fit for your company’s stage and industry. This targeted approach ensures a higher likelihood of engagement and shows the investors that your project aligns with their interests.

Crafting Your Cold Email

The Significance of A Compelling Subject Line

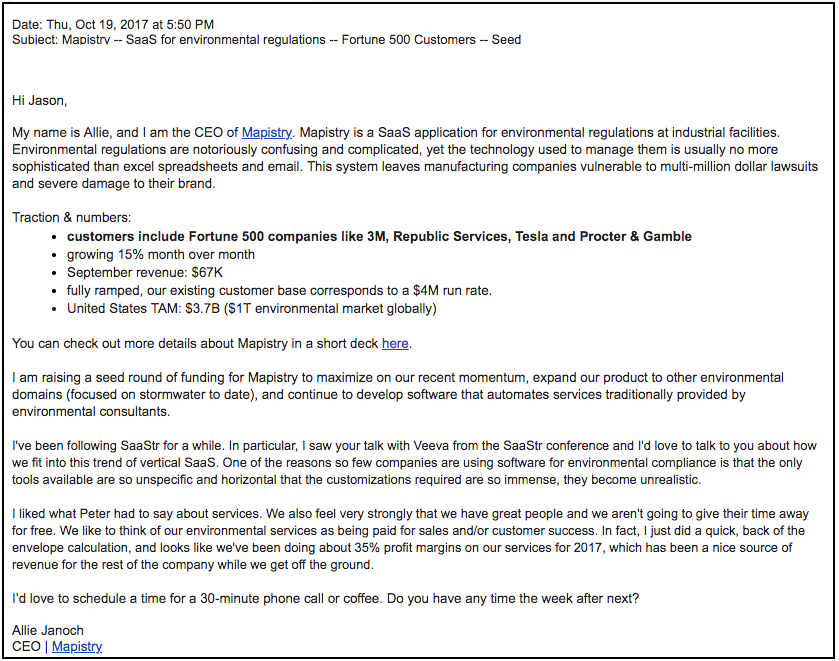

Your subject line is your first impression. It should be clear, intriguing, and specific, reflecting that you’ve done your homework and see a potential fit with their investment strategy.

Structuring the Email Body Effectively

Here’s a potential framework for the email body:

- An opening that establishes your connection with the investor

- A concise elevator pitch of your startup

- Key milestones or traction your company has gained

- A clear ask or next step

Personalizing Content To Stand Out

Personalization is key to standing out in an investor’s overflowing inbox. As advised in the article “How to Cold Email an Investor”, “Highlight any affinities or overlapping investment sectors you found.”

Essential Components of the Email

Demonstrating Value and Growth Potentials

Show why your company is a promising investment. Discuss traction, revenue, user growth, or unique tech that sets you apart.

Including the Right Attachments Or Links

Incorporate a crisp executive summary or pitch deck. Make sure any attachments are relevant and amplify the case for your company.

Timing and Frequency of Follow-ups

A follow-up demonstrates your tenacity and genuine interest but strike a balance to avoid becoming a nuisance. Wait a week or so before following up.

Optimizing Email Deliverability

Avoiding Spam Triggers

Ensure your email lands in the inbox and not the spam folder. Follow advice from “How to write a top 1% cold email to VCs – OpenVC”: “Don’t add legal mentions to your company name… Use simple words when describing what your company does… Don’t stuff the email with links and images.”

Ensuring Email Authentication

Set up proper authentication protocols like SPF and DKIM to improve deliverability and maintain a solid sender reputation.

Leveraging Email Tracking and Analytics

Utilizing Tracking Tools for Data-Driven Decisions

Email analytics can offer insights into what works and what doesn’t. Use these tools to refine your approach and improve response rates.

Utilizing Templates and Examples

The Role of Templates in Streamlining the Process

Templates can be great time-savers but require customization. A piece from “How to Write Cold Emails to Investors – Lessons from 30 VCs” suggests, “Keep the length of your cold email to an investor around 50-200 words.”

Adapting Templates to Personalize Communication

Use templates as a foundation, then infuse each email with personal touches that show your uniqueness and respect for the investor’s portfolio.

Mistakes to Avoid When Cold Emailing Investors

Being Overly Generic or Impersonal

Investors are people too. They want to feel like you’re talking to them, not at them. Tailor your message to their interests and background.

Lacking a Clear Value Proposition

Be clear about what your company does and the specific reason why you’re reaching out. Investors should understand your mission and potential immediately.

Conclusion and Call to Action

Make it easy for the investor to take the next step. Whether it be scheduling a call or reviewing detailed materials, provide a clear, low-friction path forward.

Source: Streak

As with any form of marketing, cold emailing requires patience, persistence, and a willingness to learn from each interaction. Just like Transforming Cold Emails from Ineffective to Highly Responsive, the more effort you put into personalization and clarity, the higher your chances of making meaningful investor connections.

In reviewing our advice on cold emailing investors, consider that similar principles apply across various types of marketing campaigns. Understanding and respecting your audience, presenting clear value propositions, and maintaining good communication practices are universal keys to success—as our insights on topics ranging from combining SEO with email campaigns to What is Digital Marketing? have shown.

An effective cold email could be the springboard that catapults your venture into its next exciting phase. Take the time to craft messages that will make investors take notice, and your persistence will eventually pay off with the partnership of a lifetime.